In the case of a credit card, which is a costly line of credit, the illusion might be deceiving because you aren’t actually spending real money. It is quite simple to get caught in a debt cycle. The fact that credit card interest rates are often quite high and can reach 47 percent is crucial to understand since they differ from personal loan interest rates, which can range from 15 to 25 percent. The good habit of paying credit card bills on time can be broken by one missed payment, which can quickly grow into a much larger sum. If money is tight, you could think about getting a personal loan to pay off your credit card debt.

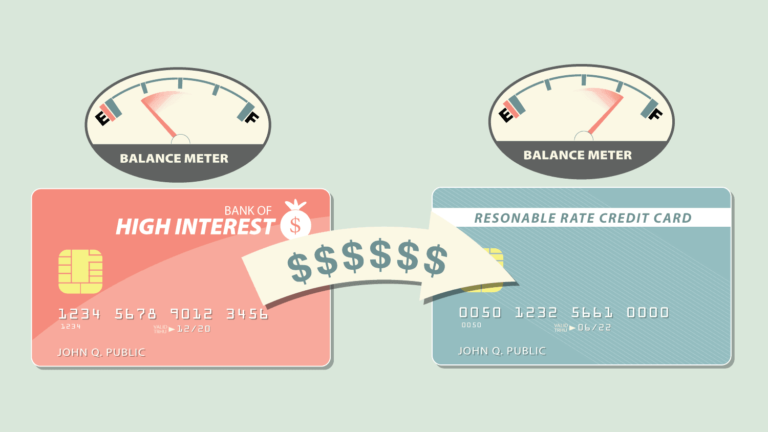

The Most Important Information about Credit Card Balance Transfer

To make an educated credit choice, you should be aware of the following information if you intend to transfer the amount on one credit card to another.

- Processing Charge: Transferring credit card balances is not free. The processing charge will be equal to a predetermined portion of the outstanding principal. The percentage would vary from 1 to 3 percent.

- Impact on Credit Score: Every time you apply for new credit, a fresh credit check is performed. Your credit score may also be impacted by each hard inquiry. If the credit application is denied, the effects will be more severe.

- Interest Rate Offer: Some lenders offer 0% interest on repayment in an effort to entice new clients. Even if it could be advantageous, keep in mind that it only lasts for a limited time, possibly between two and six months. After then, the standard interest rate will be in effect.

- Eligibility: Not every applicant for a balance transfer is accepted. Each lender has requirements for eligibility that must be met. Banks often check for applicants with a solid history of payments, credit card purchases, and transactions. Additionally, the cardholder must have utilised the current credit card for the minimum amount of time required by the bank.

- Maximum Amount: Be careful if you have a sizable balance on your existing card and wish to move it to another bank; you might not be eligible for the full amount. Up to 80% of the credit limit on your new or existing card may be transferred. A balance transfer could be challenging if your current debt is higher.

Top 5 Balance Transfer Credit Cards

The following are the Top 5 Balance Transfer Credit Cards in India:

1. Omozing

Omozing helps make Smart Money Moves for a Lifetime. They strive to get lowest interest rates and best terms for your Online Applications at www.Omozing.com . We’ve made business lending smarter, faster and easier by transforming the approval process from stumbling blocks to stepping-stones. This enables borrowers to not just get access to capital, but also understand what areas they need to work on in order to enhance their credit profile. Omozing ensures that Borrowers get a secure, safe and reliable application process that be tracked online.

5 Reasons to choose Omozing

1. Loans from INR 10k to INR 10 lakhs

Personal Loan Interest Rates starting from 0.8% p.m, and Loan amount ranging from INR 10,000 to INR 10, 00,000. The Minimum and maximum repayment period ranges from 1 month to 48 months. CIBIL 600+ all company categories (including LLP, Self Employed, Proprietorship)

2. Cutomised Tailor Options

- Depending on your demands, we may provide quick financing of varying quantities at affordable interest rates.

- You have the freedom to utilise your loan anyway you want, whether for business or for immediate personal needs.

- Flexible repayment options depending on your specific cash flow and budget, as well as conditions that is beneficial to your position.

3. Lower CIBIL

While most lenders require borrowers to have a CIBIL score of over 750, at Omozing.com provide loans even with 600. Besides the CIBIL score, we also considers your age, employment status, and net monthly income.

4. Ways to apply

You can apply for a personal loan through us by 2 ways:

1. You can download our Mobile Application from Google app store.

2. Apply on portal using out Personal Loan link

5. Prompt Loan Disbursal

An easy online application process facilitates speedy verification and disbursal of loan. Get KYC verified from the comfort of your home and have our loan manager take care of an instant transfer of funds to your account.

The Documents Required and these are the Types of Loan

2. SBI Balance Transfer

With little to no interest, SBI enables you to transfer the balance left on your credit card to an SBI Card. It is possible to divide the payment into manageable monthly instalments.

- Interest Rate for SBI Card Balance Transfers:

Choose between 0% interest for a 6-month repayment period and 1.7 percent per month for a 180-day payback period.

- Processing Charges for SBI Card Balance Transfers

No processing costs are assessed throughout the 6-month payback period. 2 percent or 199, whichever is higher, will be levied for the 180-day payback period.

People who have a Visa credit card can transfer the unpaid balance to another cardholder in 3 days, and other cardholders will get a check in the mail in 5 working days. You can submit an application for a balance transfer online at the bank’s official website, by SMS, a mobile app, or by phoning a customer service representative.

For as little as Rs. 5,000 and as much as 75% of your credit limit, you may reserve a balance transfer. At the time of booking, you will be informed of your maximum BT booking allowance.

3. HDFC Bank Balance Transfer on EMI

Based on how the customer uses their credit card, eligibility is assessed. Calling the customer service representative will allow you to verify your eligibility. The following are some appealing characteristics of HDFC Bank Balance Transfer:

- There is no need for paperwork or documentation, and you may pick a tenure between 9 and 48 months.

- The transferred money is subject to a monthly interest rate of 1.10 percent.

- Rapid distribution

- You may choose an EMI ranging from Rs. 27 to Rs. 10,000.

4. ICICI Bank Balance Transfer

For you to be qualified for a balance transfer with ICICI Bank, the minimum balance on your other cards must be Rs. 15,000. In terms of credit card purchases and transactions with ICICI Bank, the consumer should have a solid track record.

- Up to Rs. 3 lakhs can be sent as the maximum amount for a balance transfer.

- Repayment Options: You may choose between a three- and six-month repayment schedules.

- Interest Rate: Depending on the profile of the customer, the bank determines the interest rate at its exclusive discretion.

- Demand Draft or NEFT would be used for the fund transfer method. To balance transfer@icicibank.com, the client must email personal and financial information.

5. HSBC

The HSBC balance transfer feature is available for tenures ranging from three months to twenty-four months. Additionally, interest rates are levied according on the term, and a processing fee can be necessary. Similar to SBI, customers may use the balance transfer feature by phoning the bank, sending an SMS, or even just sending them an SMS. HSBC does provide the option to foreclose on the balance transfer, with no further fees possible.