Cheques are the backbone of the banking industry and are still a very important negotiable instrument in the country. Reserve Bank of India (RBI) report says India’s cheque volumes declined only by 10.8% between 2012 and 2017, though the apex bank does expect the volumes to go down drastically by 2021.

While traders and small businesses still conduct a lot of their transactions through cheques, seniors, who are not so comfortable with mobile-based apps and other digital modes, too prefer them. In fact, even the savvy ones can’t really do away with using them as cheques are still accepted by a lot of educational and other institutes, including financial ones that ask for a “cancelled” cheque before you make an investment. Here are three things all cheque users need to know.

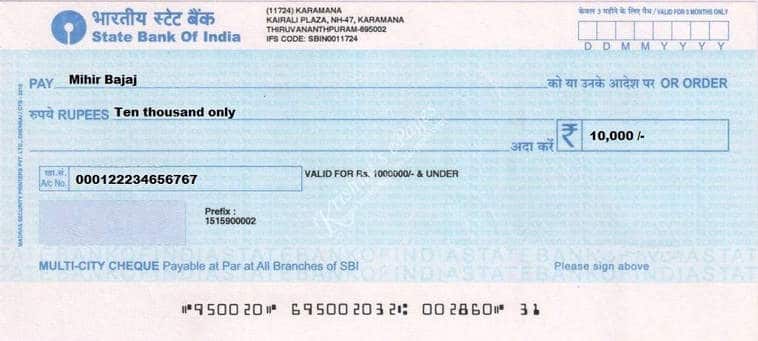

How to Write a Cheque?

Step 1: The first step is to cross a cheque, which means to draw two lines, which are parallel to each other, on the left hand corner of the document.

Step 2: Write the date and write the name of the payee in the ‘Pay’ column. Proceed to write the amount in words and add ‘only’ in the end,

Step 3: And then write it in numbers followed by this symbol ‘/-.’

Step 4: Sign at the bottom of the cheque

How to Apply for a New Cheque Book?

Applying for a cheque book is an easy process and can be done using various methods such as applying online, through an ATM, visiting the branch or using your bank’s mobile app. Also, every cheque book comes with a requisition slip, all you need to do is fill the same and submit it to get a new cheque book.

1. Internet Banking

This is probably one of the most hassle-free and easy methods to apply for a new cheque book. When you log in to the internet banking account of your home bank, you can request for a cheque book by mentioning certain details like account number and mailing address. In most cases, the cheque book is delivered to the residential address or the address that is linked with the bank account.

2. ATM

This is a simple process and one of the fastest ways to get your cheque book. Below is the stepwise process that tells you how to apply for a cheque book through an ATM:

- Go to your bank ATM and insert your debit card

- Proceed to enter your pin and select the ‘issue new cheque book’ option

- Click on submit.

- Your request will be submitted and your cheque book will be mailed to your residential address.

3. Mobile App

Log in to the mobile app of your bank and apply for a cheque book. This is easy and can be done in a matter of seconds.

Digital Cheques

You may be using a physical cheque book, but at the back-end, banks have moved on to what’s loosely called digital cheques under the cheque truncation system (CTS). Thanks to the system, banks are spared the task of transporting a physical cheque from the presenting bank (where the cheque is deposited) to the drawee bank (where it is issued).

Currently, all banks are issuing CTS-compliant cheques to customers. With CTS system offering higher benefits in the form of shorter clearing cycle, nil collection charges, superior verification process, among other things, non-CTS cheques will soon become redundant.

Types of Cheques

1. Crossed Cheque

This type of cheque ensures the money is credited into the account of the person or entity in whose favour the cheque is issued. To cross a cheque you have to draw two parallel lines on the left-hand upper corner of the leaf. It is preferable to write “account payee” or “non-negotiable” along the lines.

2. Bearer Cheque

Here, the payment is made to the person who is acting on behalf of the beneficiary in whose favour the cheque is issued. The word “bearer” has to be written on the cheque and these are risky in nature. If they fall into wrong hands, you may lose your money. Recovering this money may involve several steps, including filing a police complaint.

3. Order Cheque

Here, the payment is made to a specified person. In these cheques, the word “bearer” has to be cancelled, and the name of the person who is supposed to draw the money is to be mentioned. The bank will release the funds to this specified person upon seeing an ID. Bearer and order cheques are also known as open cheques and you can encash them over the counter at any bank

4. Loose Cheque

When you make a new cheque book request, it typically takes at least five business days before you receive it. In the interim, if you need to use a cheque urgently, banks issue loose cheques for a fee. For instance, ICICI Bank Ltd charges ₹25 per loose cheque leaf.

Cheque Bounce

Cheque transactions in India are governed by the Negotiable Instruments Act, 1881 along with the Reserve Bank of India. When a cheque is not processed successfully, it is deemed “bounced”.

A cheque can bounce for a number of reasons such as mismatch in the issuer’s signature with the bank’s records or insufficient funds. Remember that there are consequences to face for a cheque bounce.

- First, both the issuer and the receiver of the cheque are fined by their respective banks. The penalty is ₹300 and ₹100, respectively, but may vary from bank to bank.

- Second, a bounced cheque can hit your credit score. A cheque bounce will lead to the lender reporting it as non-payment within the stipulated period, and this will adversely impact your CIBIL score. If the bounced cheque is not credit-related, it will not impact your score, but will still affect your financial credibility.

- Third, if a cheque is bounced wilfully (where there is no intention to pay or there’s an intention to cheat or there are defaults despite the capacity to repay), the defaulter can be prosecuted. If the cheque is dishonoured wilfully, the defaulter can be prosecuted under Section 138 of the Negotiable Instruments Act or Sections 417 and 420 of the Indian Penal Code, 1960. The defaulter can be punished with a prison term of two years and or has to pay a fine that is as high as twice the cheque amount.

According to RBI rules, your bank will stop issuing you a cheque book if you are booked repeatedly for the offence of cheque bounce. However, RBI states that such action can be taken only if cheques valued ₹1 crore or above bounce more than four times.

8 things you must know about Cheque

1) Validity of Cheque-Till now it is 3 months for Cheques/Drafts/Pay Order.

2) Cheque Truncation-This is new process implementation by RBI to mitigate physical loss of cheques and frauds.

3) Writing with postdated cheque-This habit may force you in trouble if you not properly track about the dates and due to insufficient funds cheques may get dishonored. Hence it is advisable to avoid such type of habit.

4) Alteration and Counter Sign-This is strictly not allowed by banks to avoid frauds. Hence before writing cheques make sure no alteration and not try to counter sign for that alteration.

5) What is Order Cheque and Bearer Cheque- Order cheque means amount should be paid to the particular person or entity whose name is written on cheque. But bearer cheque means the payment should be made to the person who holds the cheque.

6) Banker’s Cheque-Cheque drawn on Bank is called Banker’s Cheque. Bankers are guarantee in this case. It is exactly like DD but when issued in same city then Banks use Banker’s Cheque while for issuing other cities DD is used.

7) Missing Cheques-When you miss few cheque leaves from your cheque book then you need to inform your bank about this and use stop payment facility against the missing cheques.

8) Writing down Cheque details before giving it to someone-Write cheque no, date written on cheque and to whom it is issued with amount for your future reference.