Table of Contents

Health Insurance

Health insurance takes care of your medical expenses and ensures that out-of-pocket expenses are curtailed up to the Sum insured

A health insurance policy ensures that you can avail cashless treatment at a network hospital, typically covering 30 days and 60 days pre and post hospitalization, respectively, in most of the Health Insurance plans.

Types of Health Insurance Plans

- Coronavirus Health Insurance Plans

- Individual Health Insurance Plans

- Family Health Insurance Plans

- Senior Citizen Health Insurance Plans

- Critical Illness Insurance Plans

- Maternity Health Insurance Plans

- Personal Accident Insurance Cover

5 Advantages of having a Health Care Plan

1. Coverage against medical expenses

The main purpose of medical insurance is to receive the best medical care without any strain on your finances. Health insurance plans offer protection against high medical costs. It covers hospitalization expenses, day care procedures, domiciliary expenses, and ambulance charges, besides many others. You may, therefore, focus on your speedy recovery instead of worrying about such high costs.

2. Coverage against critical illnesses

Insurance providers nowadays offer critical illness insurance, either as a standalone plan or as a rider. Such an insurance policy provides coverage against life-threatening diseases such as kidney failure, bone marrow transplant, stroke, and loss of limbs, among others.

3. Cashless claim benefit

Many insurance providers offer cashless claim facility. In such an arrangement, you do not have to make any out-of-pocket payments. The hospitalization expenses are settled between your insurer and the hospital. To avail of this benefit, it is imperative to get admitted at any of the insurer’s network hospitals.

4. Additional protection over and above your employer cover

Many organizations cover their employees with a group insurance plan. However, such policies are not tailor-made according to the needs of every individual. Besides, you may be left uninsured in case of loss of job or change in employment. In order to protect yourself against such an event, purchase a health cover individually.

5. Tax benefits

Health care plans provide tax benefits. Premiums paid towards your health care policy are eligible for tax deductions under Section 80D of the Income Tax Act, 1961.

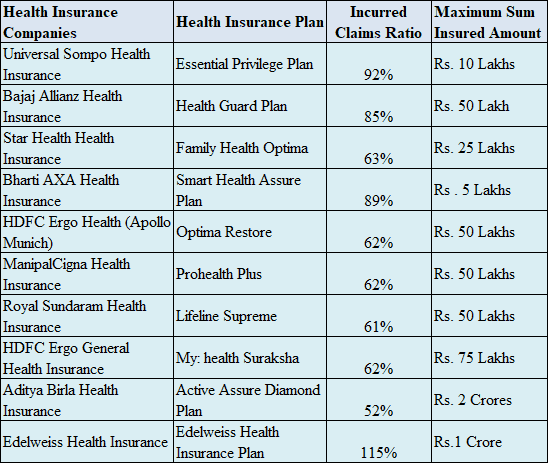

10 Best Health Insurance Plans in India for January 2021