Omozing’s Credit Score Repair Program

We provide proactive credit health improvement packages for our customers. The program helps to improve your credit score which directly impacts the creditworthiness of our customers. This allows a higher chance of loan approval at lower interest rates.Our credit dispute resolution program ensures that all the information of our customers maintained at CIBIL is accurate and no pending loan history or credit card glitches hinder their CIBIL score.

At Omozing, we are committed to get the best possible solutions for all of our customers. When you come to us we make sure to serve our customers with a customized and personalized service. We evaluate the credit report, and rectify all errors which may be the cause for you to pay high interest rates with us, or any other lender, for personal loans, home loans, auto loans, business loans, etc. We also exclusively offer the credit booster services which ensures a long term solution for your credit needs.

What makes a good credit score?

Timely repayment towards loan accounts and credit card bills, responsible borrowing makes up a good credit score.

- It is advised to not make unnecessary enquiries of your credit score as score checks also impact the credit score.

- Ensure a healthy credit mix, opt for secured loans when possible.

- Choose your EMI plan wisely so that you can easily be consistent with your payments.

- Avoid multiple applications as it reflects poorly on your CIR. Do not rush into a new application after the rejection of one, as it depicts credit hunger and may seem to be suspicious.

Plan your finances for the short term as well as long term. Invest in help from financial advisors. In case of inaccuracies in information at CIBIL or a poor score avail credit booster services offered by professionals.

- Personalised Credit Assistance

- Analysis of Credit Report

- Error identification

- Error identification

- Personalised Credit Assistance

- Analysis of Credit Report

- Rectification of Errors

- Score Booster

- Dispute Raising

- CIBIL follow up

- Personalised Credit Assistance

- Dispute Raising

- CIBIL follow up

- Rectification of Errors

- Score Booster

- Legal Assistance by Expert

- Error identification

- Analysis of Credit Report

FIX YOUR CREDIT REPORT

FAQ

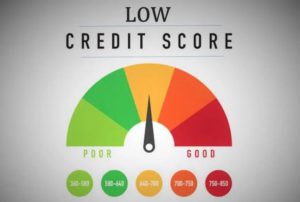

In India CIBIL defines a score between -1 and 300 to 900 for every individual based on their credit behaviour. Banks and other lending institutions give loan based on your credit score.

You can visit the CIBIL website and sign up to check your credit score. However, the number of times someone checks up your score also affects it and brings it down. Thus it is advisable to avoid unnecessary checks.

Generally 700-900 is called a good score and lenders feel comfortable giving an individual or company within this range a loan.

Yes, credit card usage directly impacts your credit score. Pay all fair dues in time. It is common for people to find glitches with credit cards and thus you can use the service offered at Omozing to rectify the misinformation with CIBIL.

Yes, Amazon EMI affects the CIBIL score.

It takes about 30 days for rectification of errors in CIBIL. The updation of score will reflect in 2-5 days after the change.

In case of a floating interest rate, an improved CIBIL score can help bring down the rates and thereby saving you charges.