Tax Saving Bonds

Tax-saving bonds are great instruments offered by the government to help people save tax. These are special documents which offer tax benefits to the owners as permitted under the Income Tax Act. These bonds have a lock-in period of 5 years.

India, the largest democracy in the world runs on the tax paid by millions of its citizens, which each Rupee paid as tax helping the country grow and prosper. Paying income tax is the duty and responsibility of every eligible taxpayer and the country has over 35 million taxpayers, accounting for hundreds of crores. While for some tax is just another source of expenditure, for others it could have a huge bearing on their life. The government, on its part has a number of schemes to ensure that taxes don’t overburden citizens, with tax savings bonds being one of the popular means to save tax.

How Can you Save Tax With Tax-Saving Bonds?

Under Section 80CCF of the IT Act, the tax-saving bonds have special privileges that allow investors to reduce their income tax liabilities by up to Rs. 20,000 in a financial year. In other words, if you have already used other deductions and exemptions but still looking for ways to reduce your tax liabilities, you can reduce the same by up to Rs. 20,000 by investing in these tax-saving bonds.

But unlike tax-free bonds, the interests you earn from tax-saving bonds are not tax-exempt. Only the initial investment amount of up to Rs. 20,000 is eligible for a tax deduction in a financial year.

Tax-Saving Bonds

- These bonds offer tax benefits to owners, therefore helping them save a certain portion of their overall tax.

- Investors can earn a certain interest on these bonds if opted for, along with the special provision in the Income Tax Act offering tax benefits on investments.

- A special provision for tax saving bonds is offered under Section 80CCF of the Income Tax Act. Under this investors get the benefit of tax deductions up to Rs 20,000. Hence, one can reduce his/her taxable income by Rs 20,000 in a year.

- Note that the interest earned through the bond is taxable. Deduction offered under section 80CCF is over and above tax deduction u/s 80C that offers tax benefit up to Rs 1.5 lakh.

- Tax-saving bonds come with a minimum lock-in period of 5 years and are ideal for mid-long term investments.

- Returns from these tax-saving bonds are low when compared to other investment as these are low-risk options. Hence, experts say, conservative investors who want to invest without high risk, could consider this investment option.

- Additionally, investors looking for long-term returns could also opt for these tax-saving bonds, as they are not suitable for individuals looking for short-term returns.

There are a number of tax saving bonds one can choose from, each unique in their own way. Some of the popular taxes saving bonds are mentioned below.

Infrastructure Bonds

Infrastructure bonds are offered by multiple banks in the country, with the investment used to develop and enhance the infrastructure of the nation. Some of the most invested infrastructure bonds were offered by ICICI bank and HDFC bank. These bonds were easy to purchase and offered tax benefits under Section 80CCF to investors, making them ideal for thousands of them. These bonds earned an interest of about 8-9% per annum, making them medium growth investment options.

There were a number of other bonds issued during the year, but these were categorised as tax free bonds, offering the benefit of no tax on the interest earned. Some of the popular tax free bonds were RBI Relief Bonds, NHAI Bonds, HUDCO Bonds, NTPC Bonds and IRFC Bonds.

Section 80CCF

Tax saving bonds enjoys special privileges under Section 80CCF of the Income Tax Act which states that individuals enjoy tax deductions up to Rs 20,000 on the bonds owned by them. This means that an investor in these bonds can reduce his taxable income by Rs 20,000 in a year, thereby saving on the overall tax he/she might have otherwise had to pay. This deduction is excluding the Rs 1.5 lakh provided under Section 80C of the Act.

How to Invest In Tax-Saving Bonds?

If you want to invest in tax-saving bonds, you can do this by visiting the nearest branch of SBI. Apart from SBI, there are more than 20 other nationalized banks that can help you invest in these bonds. The minimum investment amount for these bonds is Rs. 1,000.

You will be required to fill up a revised form either online or offline and submit appropriate documents along with a cheque or demand draft of the amount you’d like to invest. But note that you’ll need a Demat account for investing. Once invested, you will receive the bond in your BLA (Bond Ledger Account), along with the CoH (Certificate of Holding).

Who Should Invest In Tax-Saving Bonds?

Any risk-averse investor wanting to save taxes after entirely using the popular tax deductions can consider investing in these bonds. As the government backs these bonds, they come with minimum to no risk.

Also, the maturity period of 5-7 years makes them an excellent choice for investors with a mid-term investment horizon. Understand the terms and conditions of these bonds before investing to ensure that your investment delivers the expected benefits.

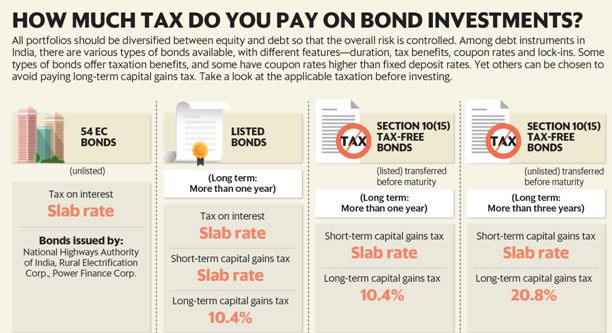

How much Tax do you pay on Bond Investments?

All portfolios should be diversified between equity and debt so that the overall risk is controlled. Among debt instruments in India, there are various types of bonds available, with different features duration, tax benefits, coupon rates, and lock-ins. Some types of bonds offer taxation benefits, and some have coupon rates higher than fixed deposit rates. Yet others can be invested in to avoid paying long-term capital gains tax. While you need to hold some till maturity to avail tax benefit, you may have to pay tax on some if you hold till maturity. Take a look at the applicable taxation before investing.