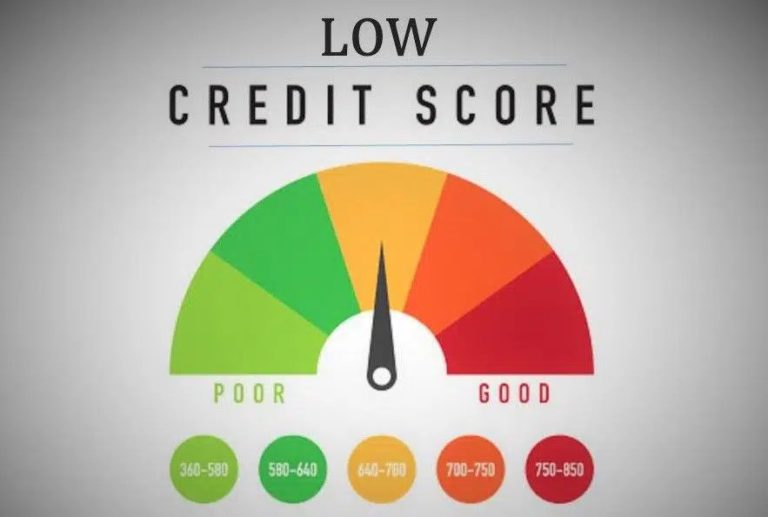

A credit score is a measure of your creditworthiness which is presented in a numerical format. It ranges between 300-900, 300 being the lowest and 900 being the highest. You should always work towards maintaining a credit score closer to 900. Majority of banks and NBFCs consider a credit score of 750 and above as ideal.

CIBIL Score for Personal Loans

CIBIL score is a credit score provided by CIBIL, which is one of India’s leading credit information companies. The score reflects a person’s credit history based on their financial behaviour. It includes loans and repayments, credit card payments, and more. The score ranges between 300 and 900; the higher the score, the healthier the credit history is.

A lower credit score can hurt your chances of being approved for a credit card, home loan, and other products. Usually, a credit score of 750 or more is considered excellent. People with a score over 750 can expect better approvals for financial services like loans. A score over 700 is decent while getting a personal loan for a CIBIL score of 550 or lower can be difficult.

Factors that lowers CIBIL Score

Since CBIL scores are supposed to be an indicator of your financial habits, the score changes based on how you handle your loans and credit cards. These are some of the factors that can have a negative effect on your CIBIL score.

1. Missing Loan EMI

If you miss an instalment on your loan then it may be viewed as poor financial planning which means that your credit rating will suffer making it difficult for you to secure loans in the future.

2. Not paying Credit Cards Bills on time

Just like the EMI for your loans, if you fail to pay your credit card dues on time, they too can have a negative effect on your credit history.

3. Too many Personal Loans

Since personal loans are unsecured loans, taking too many personal loans can cause your credit score to fall.

4. Not having any Credit

It may sound like a good place to be in if you don’t have any loans or credit cards at all when in fact it is not. This is so because not having a credit history means that your credit score is 0 by default which means that if you were to apply for a loan or a credit card, the chances of it getting rejected are higher.

5. Too many Loan Rejections

If you apply for a loan or a credit card and your application is rejected, you tend to apply with another bank and another and so on. Such practices reduce your score for two reasons. The first is that CIBIL takes constant rejects to be a bad sign and secondly because every time a bank requests CIBIL for your credit information, your credit scores come down.

Tips to Get a Personal Loan despite a Low CIBIL Score

Low CIBIL score does not always mean loan denial. Here are some situations when those who are new to credit or have low credit scores can also avail personal loans.

- Have Adequate Disposable Income: If you are having adequate monthly disposable income to repay your personal loan EMIs on time, then the lender may approve your personal loan application despite having low credit score or being new to credit.

- Check your Employer’s relationship with the Bank: Those working for reputed corporate/MNCs or public sector organizations have higher income certainty than others. Hence, lenders may accept the personal loan applications made by such applicants on the basis of their EMI repayment capacity, job stability and the reputation of their employers.

- Consider NBFCs and Digital Lenders: Many NBFCs and new-age digital lenders offer personal loans to applicants with low credit scores, albeit at higher interest rates than banks and bigger NBFCs.

- Apply with a co-applicant: Adding an earning family member as a co-applicant to the personal loan application reduces the credit risk for the lender. This is because the co-applicant also becomes equally responsible for the repayment of the loan. Hence, add a co-applicant if you are unable to avail personal loan due to low credit score.

Personal Loans with Lower CIBIL Score

Since personal loans are versatile and easier to acquire, people use them for many reasons, including buying a vehicle or remodeling the house, getting married, and repay their other loans.

While a low CIBIL score would reduce the chances of getting approved for a personal loan, it is not impossible. Other factors that affect your chances of getting a loan include your status of employment, income, and credit report. The report is a more detailed account of your financial history. A clean report suggests that you practice healthy financial habits and are not a risky candidate.

How will a bad Credit Score impact you?

A bad or lower credit score may impact you in multiple ways since you’re viewed as a big risk by the mainstream lenders and this is not a good thing. Following are the demerits of having a low credit score:

- Banks will most likely give you a loan at a higher rate of interest which means you will end up paying more than someone with a better credit score, say 750 or more. This is because banks and other financial institutions may view you as a risky customer and thus would like to recover their loan as soon as possible by levying heavy interest.

- You will not be able to access premium credit card benefits. When your credit score is high, you are given good introductory and/or cashback offers. You may also get good deals on shopping and movie tickets. A bad score may make you miss out on all these.

- You may have to pay a higher insurance premium. Nowadays, insurance companies check your credit score to see how reliable you are with timely payments. If you’re paying your credit bills and/or EMI payments on time, it will up your credit score. This will in turn make the insurance companies confident of your premium payments in time.

Reasons you have a low CIBIL score

- Credit Information Bureau of India Limited or CIBIL was formed in the year 2000 as a Credit Information Company (CIC). Now known as TransUnion CIBIL, this credit bureau collects and maintains the records of loans and credit card payments for individuals as well as businesses.

- The information regarding loans and credit card payments is provided by the member banks and other categories of lenders on a regular basis. CIBIL uses complex statistical formulas to arrive at the credit score which is known as the CIBIL score.

- Your CIBIL score is a 3-digit number that determines your creditworthiness as far as lenders are concerned. This score ranges between 300 and 900 and a score above 750 is considered a good score.

- The disadvantage of having a low CIBIL score is that your loan or credit card application may be outright rejected, you might have to wait longer than usual, there will be more paperwork involved, and you might end up paying a much higher rate of interest as well. In some instances, your application might be considered, if the lender chooses to do so.

- If your loan is disapproved, you will not be able to upgrade your standard of living. Your dreams for a home, car, children’s education will remain unfulfilled.

How to Increase your chances to secure a Bad Credit Loan?

- Prove that you can repay the EMIs – Despite your low credit score, lenders may offer you a loan if there has been an increase in your earnings. Hence, if you can communicate to the lender that your earnings have increased and you can afford to pay the EMIs, there are high chances of them offering you a loan.

- Provide Collateral – Providing collateral increase your chances to secure a loan as the risk associated with lending to you decreases. Lenders feel confident to offer you a loan as in the case of defaults, they can sell/auction the collateral to recover the loan outstanding amount.

- Apply with a Co-Applicant – When you apply for a loan with a co-applicant who is creditworthy, your eligibility to secure a loan gets enhanced. So, when you have a low credit score and you wish to secure a bad credit loan, applying with a co-applicant is a good idea.

How will a bad Credit Score impact you?

A bad or lower credit score may impact you in multiple ways since you’re viewed as a big risk by the mainstream lenders and this is not a good thing. Following are the demerits of having a low credit score:

- Banks will most likely give you a loan at a higher rate of interest which means you will end up paying more than someone with a better credit score, say 750 or more. This is because banks and other financial institutions may view you as a risky customer and thus would like to recover their loan as soon as possible by levying heavy interest.

- You will not be able to access premium credit card benefits. When your credit score is high, you are given good introductory and/or cashback offers. You may also get good deals on shopping and movie tickets. A bad score may make you miss out on all these.

- You may have to pay a higher insurance premium. Nowadays, insurance companies check your credit score to see how reliable you are with timely payments. If you’re paying your credit bills and/or EMI payments on time, it will up your credit score. This will in turn make the insurance companies confident of your premium payments in time.

Reasons you have a low CIBIL score

- Credit Information Bureau of India Limited or CIBIL was formed in the year 2000 as a Credit Information Company (CIC). Now known as TransUnion CIBIL, this credit bureau collects and maintains the records of loans and credit card payments for individuals as well as businesses.

- The information regarding loans and credit card payments is provided by the member banks and other categories of lenders on a regular basis. CIBIL uses complex statistical formulas to arrive at the credit score which is known as the CIBIL score.

- Your CIBIL score is a 3-digit number that determines your creditworthiness as far as lenders are concerned. This score ranges between 300 and 900 and a score above 750 is considered a good score.

- The disadvantage of having a low CIBIL score is that your loan or credit card application may be outright rejected, you might have to wait longer than usual, there will be more paperwork involved, and you might end up paying a much higher rate of interest as well. In some instances, your application might be considered, if the lender chooses to do so.

- If your loan is disapproved, you will not be able to upgrade your standard of living. Your dreams for a home, car, children’s education will remain unfulfilled.

Parameters to fulfill to get a Low CIBIL loan

1. Calculate your Needs

Do not apply for a personal loan with a low CIBIL score if there is no need. You can use personal loan EMI calculator to get a better picture of how long will be required to pay EMIs at different interest rates. Based on these calculations, you can start your loan application process online.

2. Ensure all your Documents are in place

Personal loans require minimum documentation, so you only need to gather all the right stuff and ensure it is per requirements. It includes your proof of identity and residence, salary account bank statement for the past three months, and salary slips for the past three months. Self-employed individuals must furnish proof of income, proof of office address, and bank account statements from the past six months.

3. Do Research before you apply

A select few banks or financial institutions may be willing to offer personal loans for a CIBIL score of 550 or close to that. They may charge a higher personal loan interest rate. Find these banks and apply to only a select few. Applying to multiple places does not reflect well on your credit report.

Which Lenders offer Bad Credit Loans?

If you have a low credit score, pledging collateral can help you get a good deal on loans. Providing collateral lowers the risk associated with lending to you and hence, you can negotiate with the lenders to offer you lower interest rates. Such loans that are given against collateral/security are known as secured loans.

However, if you do not have any collateral to pledge and are looking for unsecured loans, you may be eligible for a loan if your monthly earnings are on a higher side and you work for a reputable firm. In such cases, banks will charge you higher interest rates and there are also chances of you getting lower loan amounts. For instance, if under normal circumstances, your loan amount eligibility is about 80% to 90%, it will be 65% to 70% because of your poor credit score. There are also chances that you will be offered shorter repayment tenures as banks will look at collecting the loan amount as soon as possible.

Apart from banks, there are two other options that you can try if you have a poor credit score and wish to avail a personal loan:

- Non-Banking Financial Companies (NBFCs) – There are many NBFCs that will offer you a personal loan despite your low credit score but may charge a slightly higher rate of interest. Usually, NBFCs are more flexible than banks when it comes to credit scores. Some NBFCs have sanctioned loans for credit scores that are as low as 360.

- Peer-to-Peer Lending (P2P) – There are some lending websites, called P2P websites, that offer loans of up to Rs.5 lakh with tenures ranging between 12 months and 60 months to people with low credit score.

Alternatives to Bad Credit Loans

- Speaking to your current financial provider to offer you a tailored loan considering your circumstances. The current financial provider may be able to help you out in this regard than you going to a new provider for a loan.

- You can get an overdraft on your current account at 0% interest rate for a certain amount. Never cross your limit on the overdraft as the unarranged overdraft fee will turn out be very expensive.

- Credit unions that are community operated can offer a real alternative to banks to those going through financial difficulty. You need to be a member of the credit union to avail the loan. These organisations are supportive and their main intention is to serve their members.

- Credit cards are another option that is available to those with a bad credit history. There are dedicated cards for the people with bad credit ratings. Though they may have lower credit limits or with higher interest rates. Also remember a failed application will damage your credit card further.

- There are payday loans. But it is advisable not to take this loan.

- Use your own savings for as long as you can. It is better to have used your saving than to pay the high interest those are being charged on loans.

- The government also offers interest-free budgeting loans to those who can’t afford their rent. But those with urgent requirements only will receive the loan.

- Turn to your family and friends for a loan. You can work out a mutually beneficial deal out and they will be much more understanding than any financial body. You can agree on a feasible interest. Be clear as to how you will make the repayment as there is a good chance that the relationship may be affected due to this. Agree on a certain time frame and commit to it.

Side Effects of a Bad Credit Score

1. Problems in Getting Approval of Loans and Credit Cards

Individuals require money to meet their various financial needs and how do they get the money?

They can apply for Secured (Home Loan, Loan against Property, etc.) or Unsecured (Personal Loan) to meet their needs. While getting any kind of loan, lenders ensure that they face minimum credit risk. In the case of secured loans, they have an individual’s assets as collateral. But in the case of unsecured loans, they have not any such thing. That’s why the role of a Credit Score becomes important here. Individuals with bad credit scores will face problems in getting approval of the personal loan and car loan.

Other than a personal loan and car loan, individuals also face problems in getting a credit card due to bad credit scores. Lenders always check the credit score of an individual before providing the credit card. In case a lender approves a credit card to an individual with a bad credit score, chances of getting a higher credit limit on their credit cards are quite low due to obvious reasons related to bad repayment behavior. Apart from this, lenders will not offer special schemes on credit cards to people with bad credit scores.

2. Higher Rate of Interest

While some lenders may outright reject your application, there may be a few lenders who may still offer to lend to you inspite of a bad credit score. To compensate for their increased risk in lending to you, they may agree to lend at a higher rate of interest.

You may be under the impression that a percentage or two of a higher rate of interest does not matter much. You may be right if it is a very small amount of loan with shorter tenures. However, when you consider bigger loans like a car or home loans, a percentage or two higher also matters a lot.

3. No Balance Transfer Facility or Top-up Loan Amount

A Balance Transfer facility helps those customers who are struggling with high-interest rates on their loans. This allows customers to transfer their outstanding principal balance to some other lender at a lower rate than the current one. But there’s a catch. Lenders do not provide this facility to people who have bad credit scores. Before permitting any borrower to transfer his or her outstanding balance, lenders check their credit score. Individuals who have bad credit scores (below 600) will surely face difficulty in availing of this facility. Lenders make sure that a borrower has been paying his or her EMIs on time until the time he or she wants to avail of the Balance Transfer facility.

Lenders offer low-interest rates on a balance transfer to people with a good credit score. But due to bad credit scores, lenders may not allow a Balance Transfer facility. Apart from this, people with bad credit scores may also miss the top-up loan amounts over and above the existing loan amount which can be a huge setback for you if you need some extra funds. On the other hand, creditworthy borrowers can easily opt for both Balance Transfer and Top-up facility on different kinds of loans at affordable rates.

4. Loans on Unfavorable Terms

While some lenders may agree to lend at a higher percentage of interest, some others may agree to lend, but at terms, that may not be favorable to you. These may end in different forms.

The approved loan amount may be much lower than what you actually applied for, which would again create unnecessary hassles for you in terms of arranging the rest of the amount. A shorter tenure may be approved. A short tenure with the same amount of loan would mean higher EMIs, which may prove to be a strain on your budget. Bigger down payment may also be demanded to approve your loan.

On the other hand, you may be approved a Prepaid Credit Card or Credit Card against a Fixed Deposit, both of these may not solve your purpose of owning a credit card. While the above-mentioned effects are directly related to your bad score and your future credit prospects, there can be many more which may come across as side effects of a bad credit score

5. Lower Personal Loan amount Disbursal

When an individual has a bad credit score, a lender does not feel safe in lending the higher loan amount in the case of a personal loan. The reason is pretty simple. An individual with a bad credit score has a history of missed repayments and irresponsible credit behavior. A lender does not want to provide a loan amount to such individuals, that too without any security. As in the case of a personal loan, lenders have not any kind of asset on which they can fall back to recover their loan amount. That’s why people with bad credit scores usually get a lower loan amount as compared to individuals with a high score.

6. May Affect your Employment Prospects

Though not in popular practice yet, increased numbers of employers are asking credit reports of candidates during job interviews. This is especially true for sectors like financial services, insurance, telecom, and regulators like the SEBI or the IRDAI.

A bad credit score often acts as a deterrent as the individual comes across as a financially undisciplined person. It is also thought that a bad credit score means a debt trap and an individual may not be able to focus much on the job at hand due to debt resolution.

Though you may have genuine reasons for a bad credit score, it is better to be on the good side as you may not get a chance to give your explanation.

7. Starting your own business may be difficult

These days, everyone looks at being an entrepreneur and starting a business on their own. However, as great an idea may be, it requires funds for execution.

After bootstrapping, the first line of credit anyone looks for is from your existing banker. With a bad personal credit score, your existing banker may not like to take a risk on your venture. Approaching other sources of credit may prove more expensive for you.

The following factors are to be considered to improve your Credit Score

- Make all overdue loan payments immediately.

- All Loan and Bill payments are to be made on or before the due date.

- Apply for a Personal or Home Loan if you need one and pay all EMIs regularly.

- Monitor your credit score. It is available FREE once a year from Credit Bureaus likes CIBIL, Experian, CRIF etc.