Personal loans are well known for being flexible. The flexibility in terms of loan amount and repayment makes it one of the most used credit products of the present day. One can opt for any loan amount according to the requirement as well as can pay it off as per the convenience. The loan tenure of a personal loan ranges from 12 months to 60 months. A borrower can opt for any loan tenure within the range.

In terms of the loan tenure, both short- and long-term personal loans come with their own set of benefits. While long-term personal loans help build your credit score and ensure your EMIs are affordable; taking short-term and small personal loans online can fetch you a lower interest rate. Moreover, you will need to pay less in terms of overall interest.

Long Term Personal Loans

What is a Long Term Personal Loan?

A long term personal loan allows the borrower to opt for longer loan tenure such as 3 to 7 years. A long tenure personal loan runs for a couple of years. The EMI amount of the loan will be lesser than short term loans. There are many benefits of choosing a long term personal loan but at the same time, the cons should not be overlooked. Here are the pros and cons of long term personal loans.

Pros of Long-Term Personal Loans

1. Enhances Loan Eligibility

When you opt for longer loan tenure, it will help you to get a better loan amount. A longer tenure minimises the EMI amount so the repayment becomes easy. Before sanctioning any kind of loan, lenders do check if the borrower is able to pay off the loan easily. In the cases of low EMI amount, the lenders easily sanction a higher loan amount as the chances of defaulting become less.

2. Keeps the EMI Amount Smaller

As mentioned above, longer tenures minimise the EMI amount, it becomes easy for the borrower to pay off the loan. One can easily pay off the loan without making huge alterations in the monthly budget. Before applying for a personal loan check your EMI amount in personal loan EMI calculator.

3. Helps to Build Credit Score

If you want to use your personal loan to improve your credit score, then a long term personal loan works best for you. The improvement of credit score needs a quite long span of time, so taking a long term personal loan and serving the loan with discipline makes your credit score improve.

4. Being Eligible for Top-Up Loans

A longer loan makes you eligible for a top-up loan as long as the tenure runs. A personal loan borrower becomes eligible for top-up loans after paying EMI of the first 12 months. So if your loan term is for 5 years, you can become eligible for a top-up loan for 4 years. But in case of short tenure loans, you lose the opportunity.

Cons of Long Term Personal Loans

1. Paying High Interest

Interest rate is calculated on reducing balance principal. Due to loan amortization method during initial months EMI’s major portion goes towards interest than principal. This means that if you want top-up or prepay your loan than your principal amount will not be reduced significantly and you may end up paying higher interest rates

2. Being Debt-Burdened for Longer

A long term personal loan will keep you under the debt for a long time frame. Being under debt for a long time may make you feel the debt-burdened. You will always need to be disciplined with your financial responsibilities for a long span of time.

3. Lowers Eligibility for New Loans

The loan eligibility of a person is calculated on the repayment capacity. As long as you service a loan, your loan eligibility for new loans is lessened as you have fixed obligation of your ongoing loan. The lenders do check that the total payable of every month should not be more than 50% of your net monthly income.

Short Term Personal Loans

What is Short-Term Personal Loan?

As the name suggests, a short-term loan is a type of loan that is given to an individual for a short tenure that usually ranges from one month to a year. These are advantageous for individuals who are unable to get loans for a longer tenure from a bank or a lender due to various reasons. Short-term loans are generally unsecured, meaning that you do not have to provide any money or property as security for the loan amount. Short-term loans are also known as short-term instalments or short-term finance.

Pros of Short -Term Personal Loan

1. Flexible End Use

Short-term loans are multi-purpose loans. This means that they can be utilized for organising a wedding, taking a family vacation, renovating your home, paying for education, buying products such as electronics or furniture, establishing and expanding business or paying for a sudden medical emergency.

2. No Collateral Needed

Short-Term Loans are generally unsecured. This means that you do not need to provide any collateral as security in exchange for the loan amount. This is very beneficial for customers who do not have any collateral to pledge as security.

3. Minimal Documentation

The paperwork and documentation that is needed for a short-term loan is very minimal. This makes the entire process fast and easy for the customer as the documentation can be completed very conveniently with ease.

4. Quick Disbursal

Short-term loan disbursals are relatively quicker than most of the other long-term loans as you do not need to provide documentation for the purpose of the loan amount and for any assets as none are pledged generally.

5. Loan Amount

Short-term loans are opted by individuals to meet short-term needs such as paying a medical bill, a wedding expense to meet or an unplanned trip to fund. The loan amount for a short-term loan begins at just Rs.5,000 and can extend up to Rs.3,00,000. The customer can pick the loan amount based on his/her needs.

6. Tenure

Short-term loans as the name suggests are taken for a very short duration. Short-term loans are easier to get approved can be repaid very fast thereby ridding the individual of the financial burden sooner. The tenures range from 1 month to 12 months (1 year).

Cons of Short -Term Personal Loan

1. High Interest

The biggest drawback to using a short term personal loan is this that the interest rates charged are generally flat interest rate which is going to be higher than long term loans. In some cases, the rates can be quite a bit higher or near to double than you are used to. Check the difference between flat and fixed interest rates here.

2. Deeper in Debt

Many times, people take out short tertm personal loans because they are short on cash. They cannot afford all of the bills that they have and as a result, they need to borrow some money. While this will get them by in the short term, many times they will not have any more money later when the loan is due. This can just compound the problem and get them deeper in debt.

6 points to keep in mind while choosing the right personal loan terms for your needs

1. Short-Term Personal Loans do not require collateral

Short-term loans pose less of a threat to lenders in terms of repayment. As such, your lender may ask you to pledge security to obtain a loan for a lengthy tenure but not for short tenure. The security may take the form of gold, an investment or any other valuable asset.

2. Long-Term Personal Loans help meet important financial commitments

While short-term loans are more suited for emergency situations, long-term loans help you meet your life goals with ease. For instance, you can use a long-term goal to fund your child’s overseas education programme, take care of a medical expense or finance a wedding.

3. Short-term personal loans are more accessible

Today, it is possible to obtain short-term and small personal loans online with a few taps and swipes on your smart phone. Multiple players are offering such services on the Internet. You normally get funding that range up to INR 2 lakh with tenure spanning from 1 day to 3 years. Selecting the right lender is the first step towards finding the perfect match for your financial needs.

4. Long-term personal loans can give you a better interest rate

Lenders evaluate your financial profile before offering loans. Since the status of your finances is not expected to change in the imminent future, you tend to get lower personal loan interest rates on long-term loans.

5. Long-term personal loans help you reduce your EMI amounts

Long tenures help you space out your instalments over a greater number of months, thereby reducing the value of each one individually. You can split up large and small personal loans alike, over many years, and bring down the monthly cost of your loan. Use an EMI calculator to compute your instalments and remember to choose the shortest tenure you can manage. As this ensures you do not pay extra interest in the long run.

6. Short-term personal loans get disbursed more quickly

Lenders normally examine your credit score, monthly income and debt-to-income ratio before approving your loan application. While these terms may be same for both short and long-term personal loans, the fact is that the risk of non-payment is higher for long-term variants. As such, short-term loans are often approved and disbursed quickly.

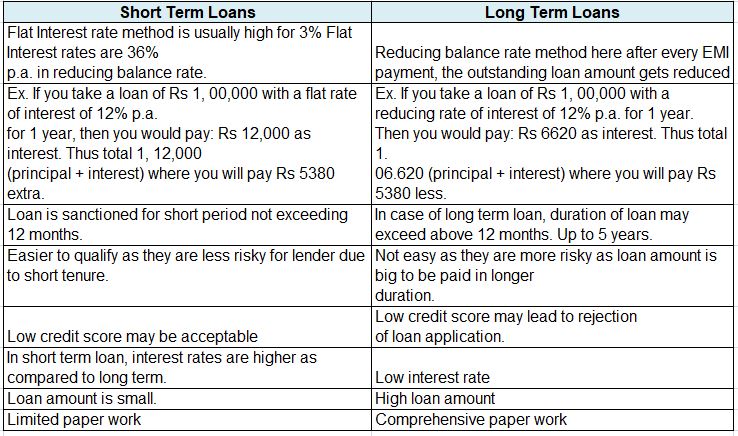

Difference between Short Term Loan and Long Term Loan

Is Long Term Personal Loan a good choice?

Personal loans are unsecured loans offered by banks, NBFCs and Fintech lending companies to creditworthy individuals. Tenures on these loans start from 1 year and stretch up to 5 years. The question of whether to choose a short tenure (1-2 years) or a long tenure (4-5 years) has often baffled customers. In this article, we observe the pros and cons of choosing long repayment tenure.

They offer flexible end use and repayment tenure that usually varies from a year to 5 years. The question to choose a short tenure (6 to 2 years) or long tenure (3 to 5 years) is debatable. Though almost all the lenders offer the privilege to choose the loan tenure as per your repayment ability, it is necessary to be careful while choosing the right tenure.

Eligibility Criteria for Long-Term Loans

Long term loans offer huge loan amounts and as such have stringent eligibility guidelines. However, these criteria differ with different lending banks. Listed below are some of the most common criteria that apply to almost all long-term loans.

- Applicant should be aged between 18-35 years of age

- Applicant should be earning a regular income

- Applicants should be a resident of India

- A guarantor is required to sign the loan application