Navigating Personal Loans for Credit Scores Between 600 and 700 in India

In India, your credit score is a crucial number that can influence your financial opportunities. It impacts your eligibility for loans, the interest rates offered

In India, your credit score is a crucial number that can influence your financial opportunities. It impacts your eligibility for loans, the interest rates offered

In India, managing debt has become a common challenge for many, with individuals often juggling multiple loans and credit card dues. The rise in easy

In today’s fast-paced world, financial stability can be elusive, and unexpected expenses can arise when least expected. Payday loans have emerged as a quick solution

In today’s fast-paced world, financial stability can be elusive, and unexpected expenses can arise when least expected. Payday loans have emerged as a quick solution

Balancing career and finances are a multi-faceted challenge that many working women in India face. The evolving social landscape, the push for financial independence, and

In an era where instant solutions are often sought for financial needs, payday loans have emerged as a popular yet controversial option. With promises of

Investing in property has long been a tried-and-true method for building wealth and ensuring financial stability. While rural and suburban properties have their appeal, city

Financial planning is crucial for everyone, but for millennials in India, it holds particular importance due to the unique economic landscape and challenges they face.

The following are the 9 hacks to improve your CIBIL score fast in India: 1. Pay Bills on Time Late or missed payments can have

The following are the 11 Factors that lead to low CIBIL Score in India: 1. Late or Missed Payments A history of late or missed

Rahul, a 26-year-old working in a MNC Bank in Bangalore, had a CIBIL score of 637 and was facing difficulty in getting a loan due

The following are the 7 Reasons How Payday Loans Can Make Your CIBIL Score Low in an Year’s Time 1. High Interest Rates Payday loans

In order to accomplish many of your goals and get through any emergency situations that may arise for many reasons, credit is crucial. Having a

The CIBIL score is one of the most important factors in obtaining the best credit cards, faster loan approval, and the ability to negotiate interest

Your credit score, also known as your CIBIL score, is a key component in deciding whether or not you will be accepted for a loan.

If you want to take out a loan in the near future, maintaining a decent CIBIL score is one of the most important factors to

Personal loans are one of the easiest loans to acquire. They are unsecured loans, which mean one does not need to offer collateral. They can

A Personal Loan is an unsecured loan given to a salaried person with a decent credit score. A credit score is thus an important determinant

Non-repayment of education loan can now affect one’s credit score, a top official of Credit Information Bureau (India) Ltd (CIBIL) has said. The data released

CIBIL score is a three digit score which determines a borrower’s creditworthiness based on their past credit history and behaviour. However, there might be discrepancies in

A credit score is a measure of your creditworthiness which is presented in a numerical format. It ranges between 300-900, 300 being the lowest and

Many credit users must be having a question about the defaulter list of CIBIL, especially while checking their credit reports. However, it is important to note

1. How can I improve my CIBIL Score? You can improve your CIBIL Score by maintaining a good credit history, which is essential for loan

Let us understand that there is no separate defaulters list with the banks or credit bodies. Rather, credit companies maintain data pertaining to your repayment

Will 1 hard enquiry affects Credit Score? Yes, hard enquiry will always have an impact on your CIBIL Score.There are two types of enquiry available

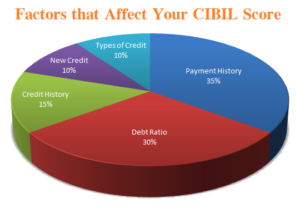

While each credit information company has its own proprietary algorithm to calculate an individual’s credit score, the most important elements of the score composition are

CIBIL aims to bring in more transparency to the loan approval process in the country, in that customer now have an understanding of the seminal

The following are the process of getting your Free CIBIL report online: 1. Visit Official CIBIL Page In this page you will be asked to create