Savings Schemes are investment options for Indian citizens launched by the government as well as other public sector financial institutions. These saving schemes were introduced as an incentive to cultivate healthy saving and investing habits in India. This is also a way to increase the inflow of money into the Indian economy. In earlier times Indians used to keep their money with themselves and this caused poor circulation as well as stagnation of wealth. By means of saving schemes, which are backed by the government, Indian citizens can allow their wealth to appreciate at higher interest rates and reap benefits such as tax exemption that certain savings schemes offer.

1. Unit Linked Insurance Plan (ULIP)

Unit Linked Insurance Plan (ULIP) is a combination of investment and insurance. In this plan insurance company puts a portion of the amount for life insurance and rest of the portion in equity-oriented a mutual fund or debt- oriented mutual fund. This division of amount to be invested is based on the long-term goals of an investor like retirement planning, children’s education, marriage, etc.

2. Equity Linked Savings Scheme (ELSS)

Equity Linked Savings Scheme (ELSS) is a type of mutual fund, with the shortest lock-in period of just 3 years, investing at least 80% of assets in equity (stocks) offering a higher compounding potential in the long term among other tax-saving schemes

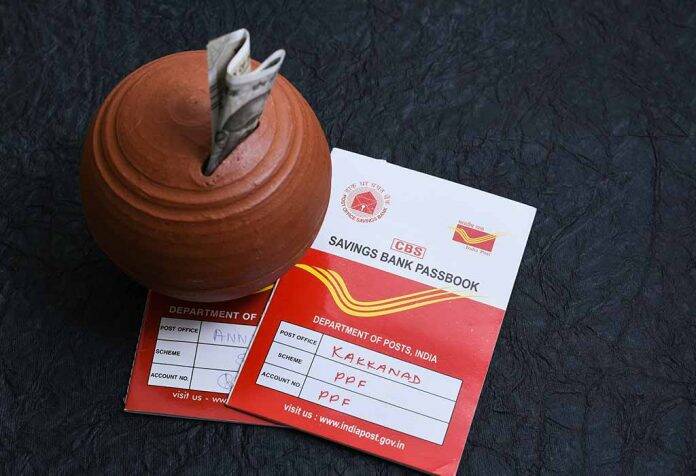

3. Post Office Monthly Income Scheme (POMIS)

This account provides monthly interest against your deposit with the post office. The minimum deposit amount is Rs 1,500 and the maximum deposit is Rs 4.5 lakhs (Rs 9 lakhs for a joint account). The interest rate on offer is 6.6%. Any number of such accounts may be opened in any post office subject to the maximum balance limit (after adding balances in all accounts). The term of the POMIS is 5 years. You can set up an ECS facility to automatically credit the monthly interest from POMIS to your savings account. You can prematurely encash it after one year of opening the account. The premature encashment penalty for such a termination is 2% of your deposit within 1-3 years. If you prematurely encash it after 3 years but before maturity at 5 years, the penalty is 1%.

4. Fixed Deposits (FD)

Fixed deposit accounts are considered to be hassle-free and the safest investment option in the market. You deposit any amount that is convenient for you, for a specified period that earns interest as per the rate prevailing on the date of deposit. The scheme offers flexibility in terms of tenure and the frequency of interest payout. The interest offered on an FD account is much higher than the one offered on a bank savings account. If you need the money before the maturity date, you can choose to break the FD or even take an overdraft loan on the FD. You also have the option to reinvest the interest to earn a higher lump sum at the end of the tenure. The interest is taxable and can be subject to TDS for payments exceeding Rs.40,000.

5. Kisan Vikas Patra (KVP)

KVP offers an interest rate of 6.9% compounded annually. It can be purchased from any post office. The invested amount doubles every 118 months (9 years and 10 months). The minimum amount for investing in KVP is Rs 1,000. Thereafter you can invest in multiples of Rs 1,000 with no upper limit. Premature encashment of the KVP Certificate is allowed 2.5 years after purchase. The KVP certificate can be held either by a single holder or as a joint holding between two individuals. It can also be purchased on behalf of a minor. This scheme offers no tax rebate on either contributions or interest earned.

6. Senior Citizens Saving Scheme (SCSS)

The SCSS is open to individuals above the age of 60 and has an interest rate of 7.4%. You can apply for an SCSS account at a bank or post office. The minimum investment is Rs 1,000 and maximum is Rs 15 lakh. The tenure of the SCSS is 5 years and can be extended for another 3 years. To extend the account, you have to give a request within 1 year of the original maturity of the account. The investment in the SCSS is tax deductible up to Rs 1.5 lakh per annum under Section 80 C but the interest on the SCSS is fully taxable. You can ask for premature closure after one year of opening the account. The premature closure penalty is 1.5% if closure is requested 1-2 years from account opening and 1% is closure is requested after 2 years.

7. NPS (National Pension Scheme)

The National Pension System (NPS), earlier known as New Pension Scheme is a pension system open to all citizens of India. The NPS invests the contributions of its subscribers into equities and debt and the final pension amount depends on the performance of these investments. Any Indian citizen from the age of 18-65 can open an NPS account. The NPS matures at the age of 60, but can be extended till the age of 70. Partial withdrawals up to 25% of your contributions can be made from the NPS after three years of account opening for specific purposes like home buying, children’s education or serious illness. The minimum annual contribution for an NPS account is Rs 1,000. There is no maximum limit but the tax deduction under section 80C and 80 CCD (1B) is limited to Rs 2 lakh per annum.

8. Pradhan Mantri Jan Dhan Yojana

Pradhan Mantri Jan Dhan Yojana is a savings scheme that is tailor-made for citizens who are below the poverty line. The account holders can make use of the scheme for reinvestments. The scheme is convenient for this class of people as they do not have to maintain a minimum balance in their accounts. They will receive additional accidental insurance cover of Rs.1 lakh and a life cover of Rs.30,000 that is payable on the death of the beneficiary. The government has made this scheme more user-friendly with the mobile banking facility. In addition to the other benefits, account holders can also avail interest on their deposits. The account holders will also be eligible for an overdraft facility of up to Rs.5,000 applicable to one account per household.

9. Deposit Scheme for Retiring Government Employees

This saving scheme is limited to the retiring public sector employees. You must open an account with any bank or post office within three months from the receipt of your retirement benefits. The interest will be paid out on a half-yearly basis, on 30 June and 31 December. You can make withdrawals from the account after completing one year. You can make a maximum of one withdrawal in a calendar year and must be in multiples of Rs.1,000. An interest rate of 7% p.a. will be applicable from the date of deposit. The interest is eligible for tax exemption under

10. Employees Provident Fund (EPF)

Employee Provident Fund (EPF) is a savings scheme operated under the EPFO guidelines. An employer and employee covered under EPF have to mandatorily contribute to a Provident Fund (PF) account in the name of the employee. EPF offers long-term retirement planning for the working class. The account is transferable from one employer to another. The account can be maintained until retirement. The employer and employee contribute 12% of the monthly salary into the provident fund account. The account if eligible for interest on the accumulated balances. The interest rate for FY 2019-20 is 8.5% p.a. The account also offers financial security for the account holders in case of emergencies. The employees’ contribution is eligible for deduction under Section 80C.